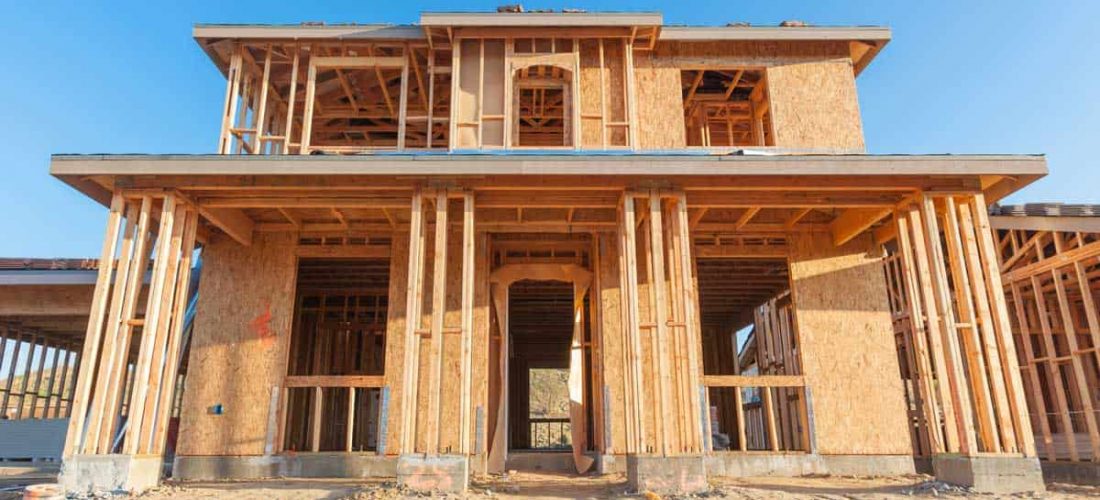

Simply put, construction-to-permanent loans starts as a construction loan, then becomes a mortgage loan once construction is complete.

Permanent Loans

Homeowners gain a lot from construction-to-permanent loans. They can:

- Purchase a lot and finance construction through all-in-one financing

- Make interest-only payments during their home build

- Pay one set of closing costs in one upfront closing

- Prepay (without penalties)

- Choose an adjustable-rate or flexible-fixed loan

Construction-to-permanent loans are a great option if you’re looking for an affordable way to finance your new home build, home addition, or renovation.

You won’t have to deal with multiple payments for multiple closings. And it’s possible your payments will be tax-deductible.

At LaBram Homes, we work with every homeowner from start to finish. That includes helping you find and secure the financing that meets your needs and gets your home built. You can now cross “Stress Out About Home Financing” off your to-do list.